PropNex Picks

|July 23,2025Resale Condo Market Watch in June 2025

Share this article:

Muted resale condo activity in June due to market uncertainties and school holidays

Sales momentum in the overall property market continued to remain subdued in June, including the resale condo market. About 828 condo units worth nearly $1.63 billion was resold during the month - compared with the 948 resale transactions valued at $1.76 billion transacted in May.

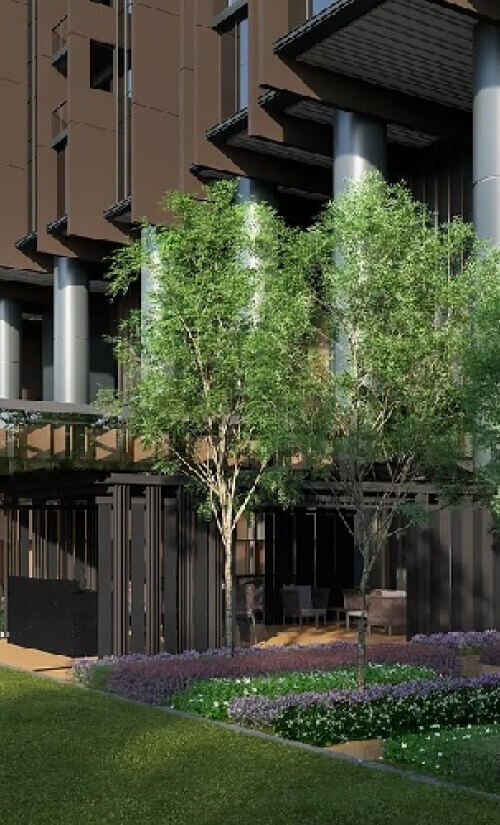

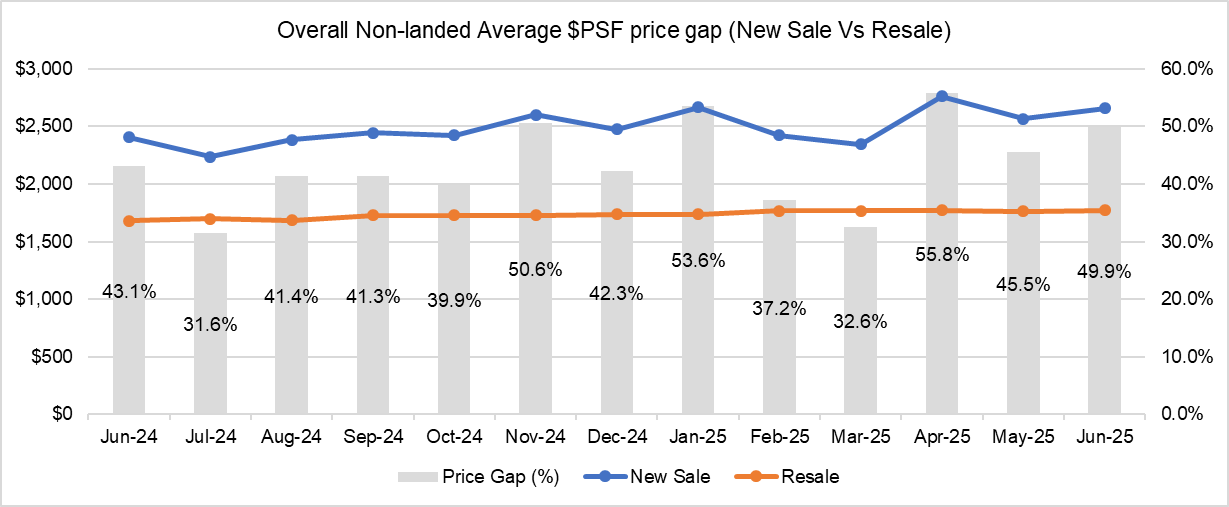

The decline in resale home market activity could have been due to the market uncertainties and the seasonal lull during the June school holidays. During the month, overall home sales activity saw a pullback as more buyers adopt a wait-and-see approach, opting to observe how the US-tariff situation would unfold before making any decisions. In June, new sales accounted for just 23.2% of non-landed transactions, while resale transactions accounted for more than two thirds of transactions (71.5%, see Chart 1).

Chart 1: Proportion of private non-landed transactions (excl. EC) by sale type by month

Due to more central region homes sold during the month, the average unit price of new non-landed homes saw a slight uptick after a brief decline in May. The average new sales price declined by 6.7% month-on-month (MOM) to $2,659 psf in June, while the average resale unit price grew by 3.5% MOM. As such, the new sale and resale price gap grew to 50% in June (see Chart 2) after dipping to 46% in the previous month.

Chart 2: New sale and Resale Price gap of non-landed homes (overall) by month

Uptick in profitability and winners

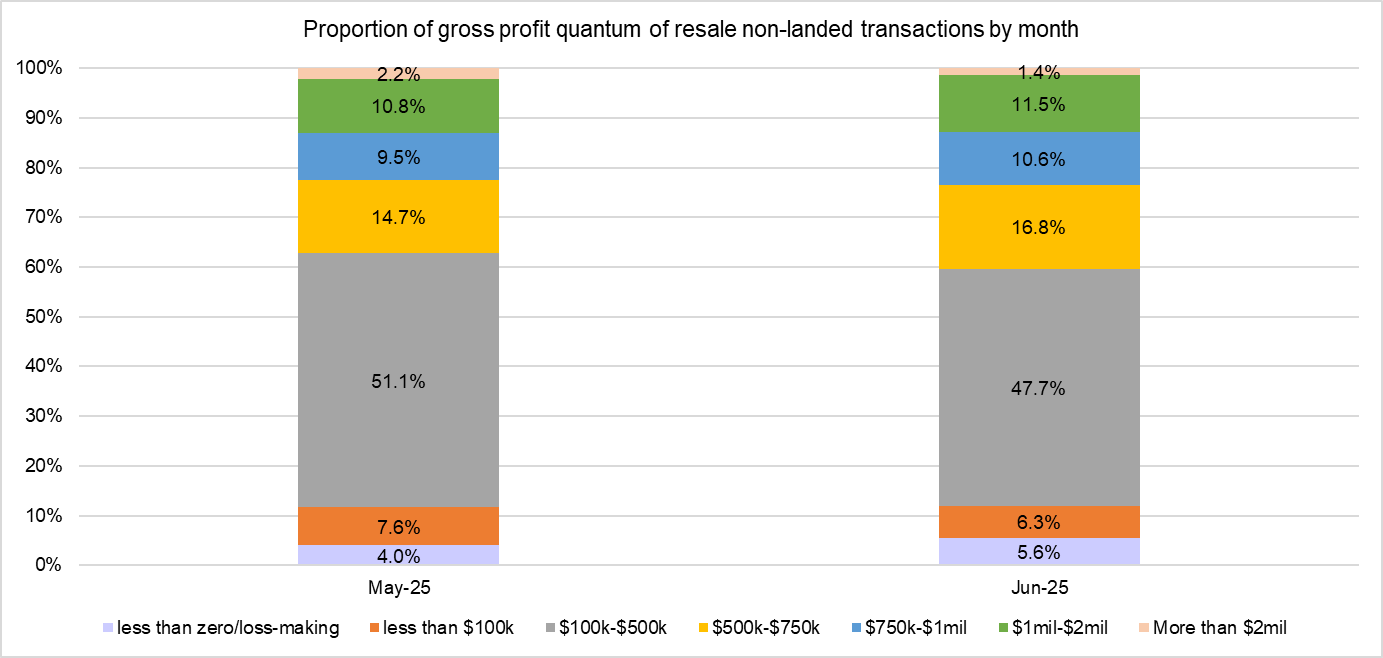

In terms of profitability, resale condo units transacted in June saw a pickup in gains compared with the previous month. Analysing the profits reaped by resale non-landed private homes in May and June 2025, it was found that resale condo deals garnered higher profits. That said, the proportion of loss-making transactions grew slightly in June 2025 over the previous month. The resale profit analysis involves computing gains achieved for the units by matching the condo resale transactions in May against their respective previous purchase price, according to caveats lodged.

The study showed that 13% of resale condo transactions (102 deals) in June made more than $1 million in profits, a similar proportion to May. Of these million-dollar profit-making deals, the deals are evenly distributed amongst the three market segments , 34.3% in the city fringe or Rest of Central Region (RCR) homes, followed by Outside Central Region (OCR) (33.3%), and Core Central Region (CCR) homes (32.4%). Loss-making deals in June accounted for 5.6% of transactions, up from 4% in May (see Chart 3).

Chart 3: Proportion of profit quantum of resale non-landed transactions (May 2025 vs June 2025)

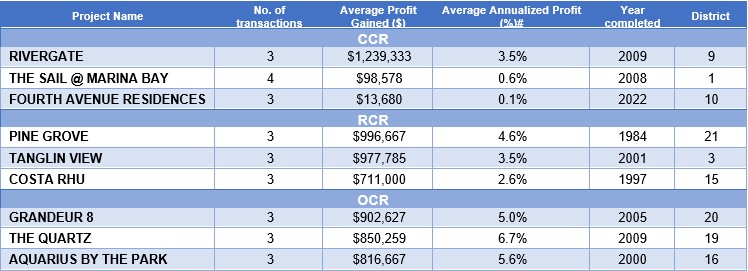

The average profit was subsequently computed on a project basis. To minimise sampling errors, resale condominium projects that posted fewer than three transactions during the month are excluded from the study. Based on URA Realis caveat data analysed by PropNex Research, the most profitable condo in the CCR, was Rivergate in District 9, which pulled in an average profit of nearly $1.24 million across three transactions in June. Rivergate was also the overall best performing project in terms of average profit quantum in June.

In the RCR, the most profitable condo development in June was Pine Grove, a project located in District 21, which achieved an average profit of nearly $1 million, across three transactions.. In the heartlands or Outside Central Region (OCR), the most profitable project was Grandeur 8 in District 20 which garnered an average profit of nearly $903,000 across three transactions.

Top Resale Condo projects^ in terms of average gross profit* by region (June 2025)

^projects with fewer than 3 transactions in the month are excluded from this analysis*Gains are derived from the resale transaction for each unit against the unit's last caveated transaction; the average profit is determined on the profits of all resale transactions in the development which occurred during the month. The profit reflected is gross - it has not accounted for the applicable seller's stamp duties, interest payable, taxes and other relevant divestment costs.

#Annualised Gains is the compounded annual rate of return which shows the rate of return over the time period between the point of resale and the property's last caveated transaction, expressed in annual percentage terms. The formula for determining this is simply: [(current resale price) / (purchase price)] time period in years-1Analysis was done based on available data from URA Realis

Going by districts, resale homes in District 10 (Tanglin, Holland, Bukit Timah) raked in the highest profits on quantum basis, with transactions reaping average gains of over $980,000 per deal. In terms of annualised gains, resale homes in District 13 (MacPherson, Potong Pasir) enjoyed an average annualised profit of 4.8% per deal.

Top 10 Resale Condo districts^ in terms of average gross profit* (June 2025)

District | No. of transactions** | Average Gains ($) | Average Annualised Gains (%)# |

D10 | 46 | $980,462 | 3.1% |

D11 | 32 | $929,801 | 3.5% |

D15 | 69 | $857,178 | 3.8% |

D21 | 29 | $772,142 | 3.8% |

D20 | 29 | $679,945 | 4.7% |

D16 | 47 | $582,036 | 4.0% |

D22 | 27 | $521,861 | 3.9% |

D12 | 21 | $500,128 | 4.0% |

D13 | 19 | $499,986 | 4.8% |

D19 | 89 | $421,189 | 4.5% |

*Gains are derived from the resale transaction for each unit against the unit's last caveated transaction; the average profit is determined on the profits of all resale transactions in the development which occurred during the month. The profit reflected is gross - it has not accounted for the applicable seller's stamp duties, interest payable, taxes and other relevant divestment costs.

#Annualised Gains is the compounded annual rate of return which shows the rate of return over the time period between the point of resale and the property's last caveated transaction, expressed in annual percentage terms. The formula for determining this is simply: [(current resale price) / (purchase price)] time period in years-1Analysis was done based on available data from URA Realis

**Resale units with no available last caveated transaction data are excluded from this analysis

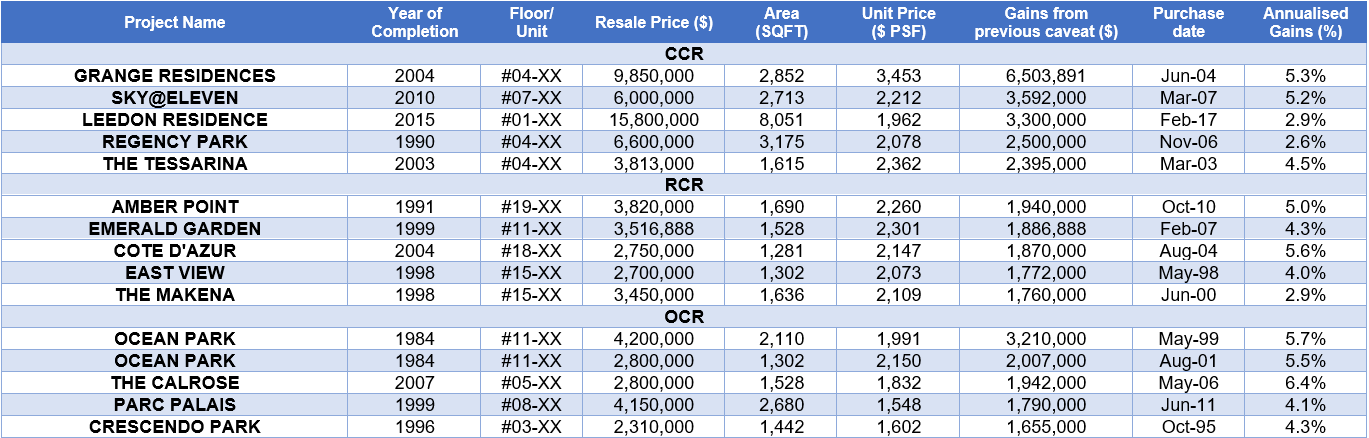

Analysing individual transactions by gross profit quantum, it was found that the top five gainers from each region ranged from $1.66 million to $6.5 million. The units which chalked up bigger gains were mostly sizeable large format condos that are more than 1,300 sq ft in size, and consisted mostly of older projects built in the 1980s to early 2000s. The respective holding periods for the most profitable resale properties were mostly beyond 15 years - the oldest being a unit held for more than 27 years.

Top 5 Resale Condo transactions in June 2025 by gross profit by region

*Gains are derived from the resale transaction for each unit against the unit's last caveated transaction; the average profit is determined on the profits of all resale transactions in the development which occurred during the month. The profit reflected is gross - it has not accounted for the applicable seller's stamp duties, interest payable, taxes and other relevant divestment costs.

#Annualised Gains is the compounded annual rate of return which shows the rate of return over the time period between the point of resale and the property's last caveated transaction, expressed in annual percentage terms. The formula for determining this is simply: [(current resale price) / (purchase price)] time period in years-1Analysis was done based on available data from URA Realis

**Resale units with no available last caveated transaction data are excluded from this analysis

It was found that the overall most profitable transaction and top gainer in the CCR was for a 4th floor unit at Grange Residences. It was resold for an estimated profit of $6.5 million, reflecting an annualised profit of 5.3%. Based on URA Realis caveat data, the 2,852-sq ft unit was first bought in June 2004 and subsequently resold for $9.85 million in June 2025, with a holding period of 21 years. The freehold project in Tanglin was built in 2004, and it is situated within the Tanglin locality. The project is situated at the doorstep of Orchard Boulevard MRT station on the Thomson East-Coast Line (TEL).

The top gainer in the RCR in terms of gross profit was for unit transacted at Amber Point in District 15, which fetched a gross profit of $1.94 million (annualised profit of 5%), based on caveats lodged. The 1,690-sq ft 19th floor apartment was sold for $3.82 million, with a holding period of nearly 15 years. The freehold project in Marine Parade was built in 1991, and it is near to the Tanjong Katong MRT station on the Thomson East-Coast Line (TEL).

Over in the OCR, the top gainer in June was a 11th floor unit located in Ocean Park in District 15. The 2,110-sq ft unit was sold for $4.2 million, achieving an estimated profit of $3.21 million - which reflects an annualised profit of 5.7% over a holding period of about 26 years. The freehold project was built in 1984 and situated within walking distance to the Marine Terrace MRT station on the Thomson East-Coast Line (TEL). The project is also near several reputable schools in the area including CHIJ Katong Primary School, Tao Nan School, CHIJ Katong Convent School, St Patrick's School and Ngee Ann Primary School.

With rising new launch prices, condo resellers may stand to benefit as some homebuyers may find themselves priced out of the new launch market and could consider options in the resale segment. That said, resale gains may potentially see some moderation, particularly amidst the economic volatilities and uncertainties around how interest rates will move in the near-term.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.